Hi there, agnieszka.slack.

You can process the Earlier Year Update (EYU) return if your payroll data has been migrated to QuickBooks Online (QBO). Let me help you accomplish this.

So you're be able to submit EYU, make sure all pay stubs are transferred in QBO. Please follow these steps to process your return:

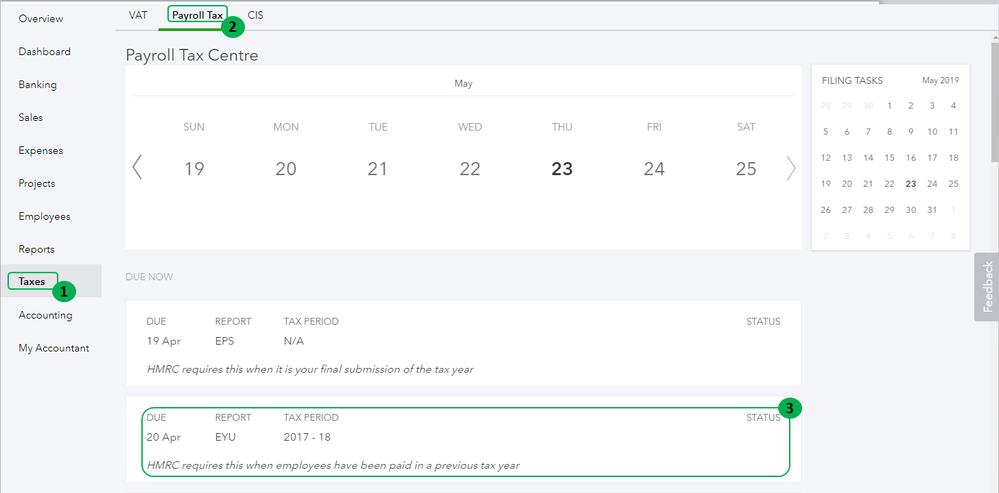

- Go to Taxes.

- Choose Payroll Tax.

- Under Due Now, select and click on the EYU return.

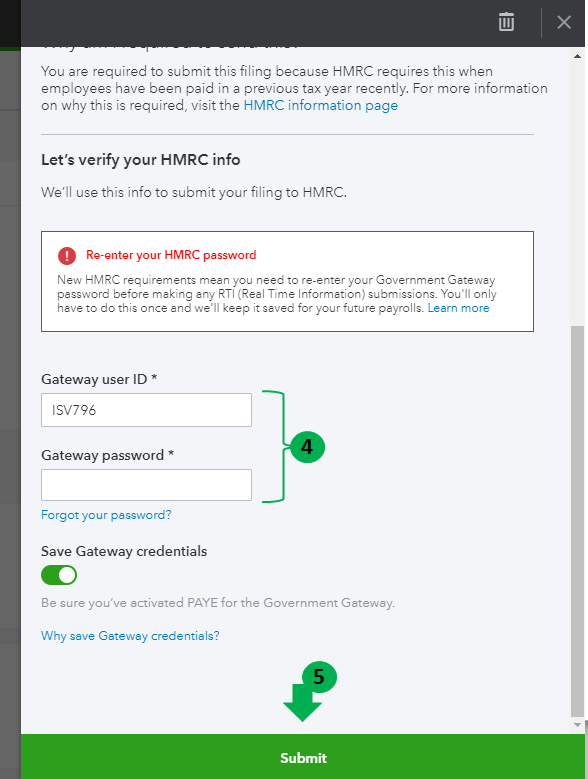

- Enter your Gateway user ID and password.

- Click on Submit.

I've attached some screenshots below, so you'll know what I'm referring to.

If there are some missing data, you'll need to submit EYU from the payroll service provider that your client processed employees' paychecks.

I'm linking an article that will help and provide further information: Transfer & Import your data for Free with Intuit Data Services: Includes QuickBooks Desktop, Sage 50....

That should do it. Let me know if you have any questions. I'll be around.