QuickBooks Ireland Temporary VAT Change

by Intuit• Updated 2 years ago

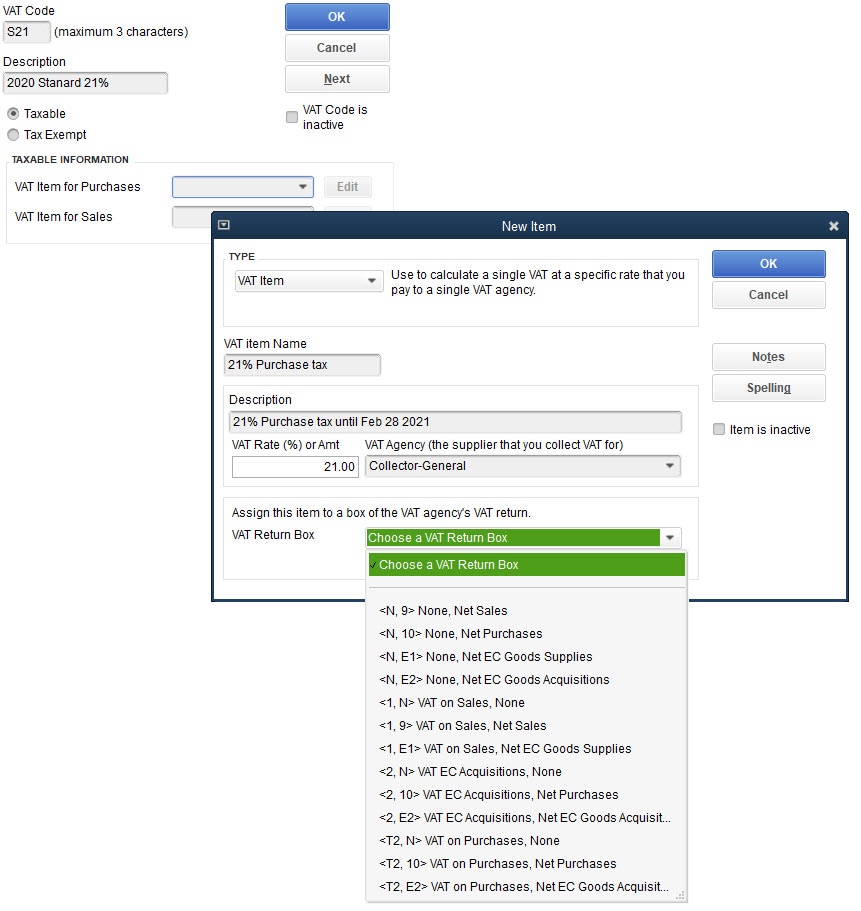

The VAT rate in Ireland is changing from 23% to 21%. QuickBooks sets the VAT items that are used most often where your business is located. However, for this VAT change, you will need to create a temporary VAT code and associated VAT items.

NOTE: You should check any reoccurring transactions to ensure the correct VAT code(s) are being used

You must sign in to vote.

Sign in now for personalized help

See articles customized for your product and join our large community of QuickBooks users.

More like this