Learn how to pay a paper paycheck to an employee who’s usually paid via direct deposit in QuickBooks Online Payroll and QuickBooks Desktop Payroll.

Do you want to pay your direct deposit (DD) employee a paper paycheck just for one time? You can do this in QuickBooks Payroll. Future paychecks will change back to direct deposit.

Check out these scenarios and follow the steps to change a direct deposit paycheck to a paper one.

Scenario 1: A paycheck hasn’t been created

QuickBooks Online Payroll

You can switch the employee’s pay method to Paper check as you run payroll.

- Go to Payroll, then Employees.

- Select Run payroll.

- Select the employee’s row.

- Below the employee's name, select the ▼ dropdown to switch the pay method to Paper check.

- Preview and submit your payroll.

Scenario 2: Direct deposit paycheck has been created but not yet sent to Intuit

QuickBooks Online Payroll

Step 1: Delete the paycheck

If the direct deposit payment hasn't been processed yet, you can try to delete the direct deposit check.

Step 2: Re-create the paycheck

- Go to Payroll, then Employees.

- Select Run payroll.

- Select the employee’s row.

- Below the employee's name, select the ▼ dropdown to switch the pay method to Paper check.

- Preview and submit your payroll.

QuickBooks Desktop Payroll

If you’ve already created the direct deposit paycheck but haven't sent it yet, you can edit it to make it printable.

Step 1: Edit the direct deposit paycheck

- Go to Employees, then select Edit/Void Paychecks.

- Change the date range to the date of the paycheck.

- Double-click the paycheck.

- Clear the Memo line that states "Direct Deposit”.

- Select Paycheck Detail.

- Clear the Use Direct Deposit option.

- Select OK, then Save & Close.

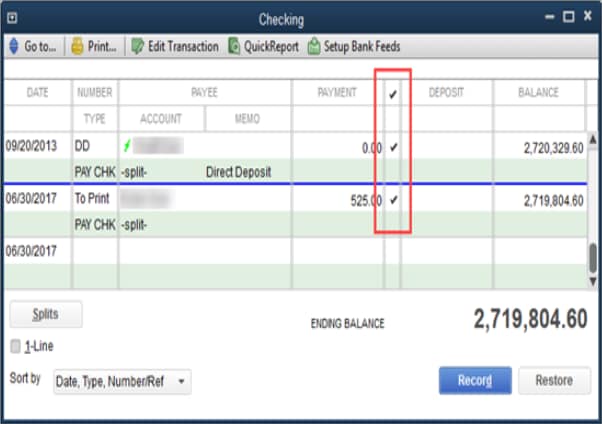

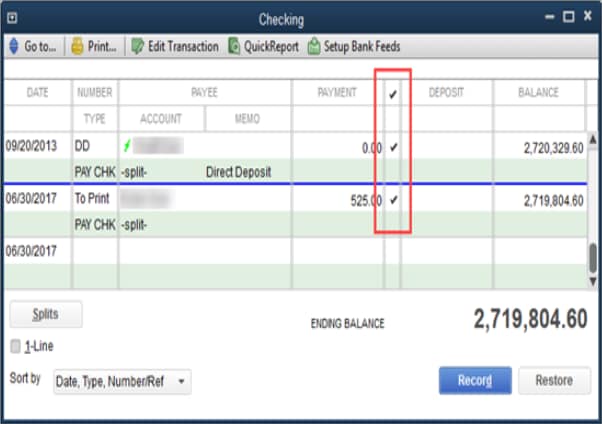

Step 2: Clear the checkbox on the register

It’ll remove the cleared mark so that the check will show on your reconciliation report.

- Go to Banking, then select Use Register.

- Select the account you use for DD from the dropdown ▼.

- Select OK.

- Find the paycheck and clear the check box next to the amount.

- Repeat these steps for each employee if applicable.

Scenario 3: Direct deposit paycheck has been sent to Intuit

If the direct deposit has been sent to Intuit, you need to void the paycheck and create a paper one.

Note: Check your payroll service processing time, to find out when QuickBooks allows you to void a paycheck.