Learn how the new features in QuickBooks Desktop Pro and Premier 2019 and Enterprise 19.0 can benefit you and your business.

To run your growing business, the easiest and most productive QuickBooks is here. Check out the new features and improvements.

QuickBooks Desktop Pro and Premier

Inactive item and industry reports

You can run reports showing your stock value. You can filter your report to include or exclude inactive stock.

- Go to the Reports menu and select Stock.

- Select either Stock Valuation Summary, Stock Valuation Summary by Site, or Stock Valuation Detail.

- Select Show Inactive Stock Items.

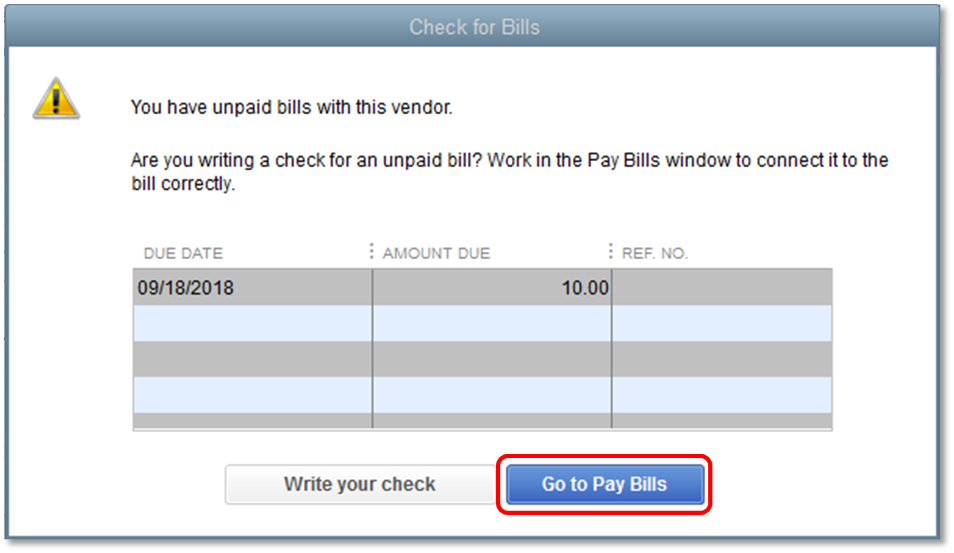

Check to bill pay

To create checks for your suppliers, QuickBooks 2019 guides you to Pay Bills when you have unpaid bills. You can write your check from the bill.

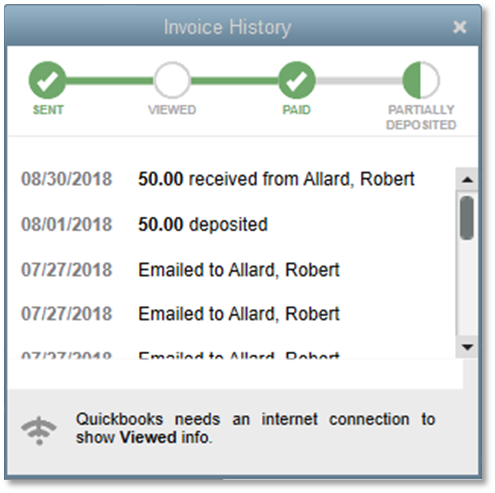

Invoice status tracker

QuickBooks 2019 has an easier way to track the status of an Invoice. Open an invoice and select the See History link. You'll see the Invoice History window and a status flow.

- Sent: You sent the invoice via email from QuickBooks.

- Viewed: Your customer received and opened the invoice. You'll only see this status if you’re connected to the internet. You may not see it if your customer’s email doesn't allow images to download automatically.

- Paid: You entered a payment for the Invoice in QuickBooks. The history displays partial and full payments.

- Deposited: You recorded a payment deposit in QuickBooks.

Transfer credits

With QuickBooks 2019, you can transfer credits in just a few clicks. No more multiple steps transferring credits from one job to another. Learn how to transfer and apply customer credit from one job to another.

IIF import

Your imported data is accurate when you use the enhanced IIF import. QuickBooks checks your data before you import it. It creates a report of issues found and the fixes. Learn how to export or import IIF files.

Accessibility enhancements

QuickBooks provides better access for the visually impaired in partnership with Job Access With Speech (JAWS). We announce window titles and fields as users hover or select them. Links are converted to buttons for easier access for the user. Learn about Accessibility and Intuit products.

Note: This improved feature is only available to users who have JAWS installed on their devices and automatically works with QuickBooks.

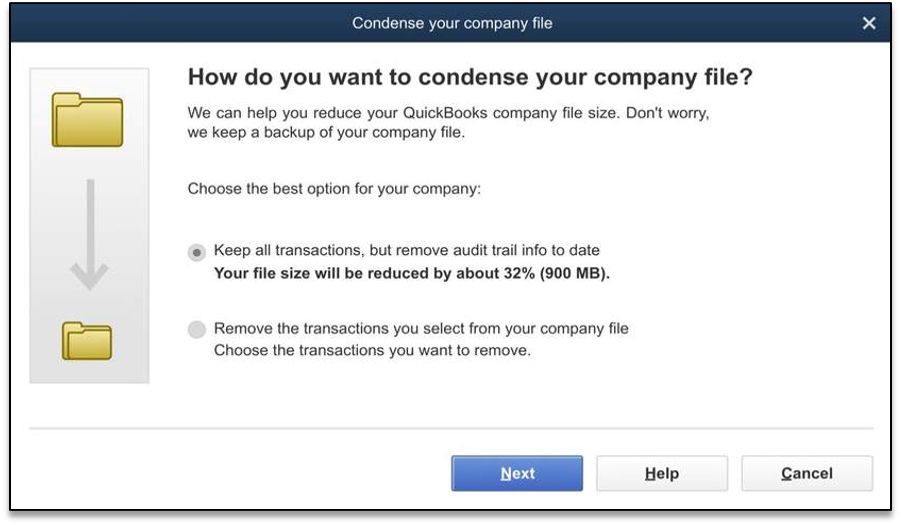

Data file optimisation

Condense your company file with the improved Data File Optimisation. You donât have to delete list elements or summarise transactions. Your file size reduces because it only removes the Audit Trail. This makes up a large percentage of your file size.

Learn how to use the Condense Data utility.

Move QuickBooks to another computer

Move your QuickBooks program and your company files to a new computer easily. All you need is:

- The old computer

- The new computer which should be connected to the internet

- An external USB flash drive with enough space for the company file

Learn how to move or reinstall QuickBooks Desktop on another computer.

QuickBooks Desktop Enterprise

QuickBooks Desktop Enterprise includes all Pro and Premier features and the following enhancements.

Manage payroll permissions

Protect your payroll and other sensitive info from unauthorised users. You can set permissions to view payroll transactions and reports. To see which areas give unrestricted view and access, use the Edit Role window.

Enhanced pick, pack, and ship

The latest QuickBooks Desktop Enterprise gives you a single place to manage all aspects of fulfilling sales orders. It includes the three major steps: pick, pack, and ship. The enhanced sales order fulfillment process is flexible. You can customise it to suit your unique business needs.

QuickBooks Desktop Payroll

Reliable sick and holiday time

Stay on top of your employee sick and holiday accruals, balances, and shortfalls with these changes.

- If an employee doesn’t have enough accrued sick or holiday time for the time to be paid on a payroll payment, QuickBooks shows a warning.

- The options to calculate sick and holiday time expands to comply with some state requirements. You can set a limit for the maximum sick or holiday time earned at any time, not just by the calendar year.

- The payslip includes more detail for the employee. They can see their accrued, used, available sick and holiday time.