We have recently introduced new features to make VAT filing easier for the customers in UAE .

Q: What are the major features and changes that will affect me?

A: Three main features have been added; new set of VAT codes, options to record transactions by location and new VAT return form.

I am an existing QBO customer and I have not set up VAT before

Q: What do I need to do to include VAT for my transactions?

A: The process is easy, once you login to your QuickBooks Online account, select the 'Tax' section on the left menu bar, there you will find the ability to 'turn on VAT'. All required VAT rates and agency will be setup for you automatically. Simply, select the VAT code under the Tax column when creating transactions.

Q: How do I file my returns?

A: VAT amounts will be automatically calculated based on the VAT codes selected for different transactions. All you need to do is to go to the 'Select the 'Tax' section on the left menu bar and click on 'prepare return' for the period you would like to file.

I am an existing QBO customer and I have set up custom VAT rates

Q: What happen to my existing transactions?

A: The custom VAT codes, agency options and all existing transactions you have recorded prior to 1st April in QBO remain unchanged.

Q: How do I record new transactions moving forward?

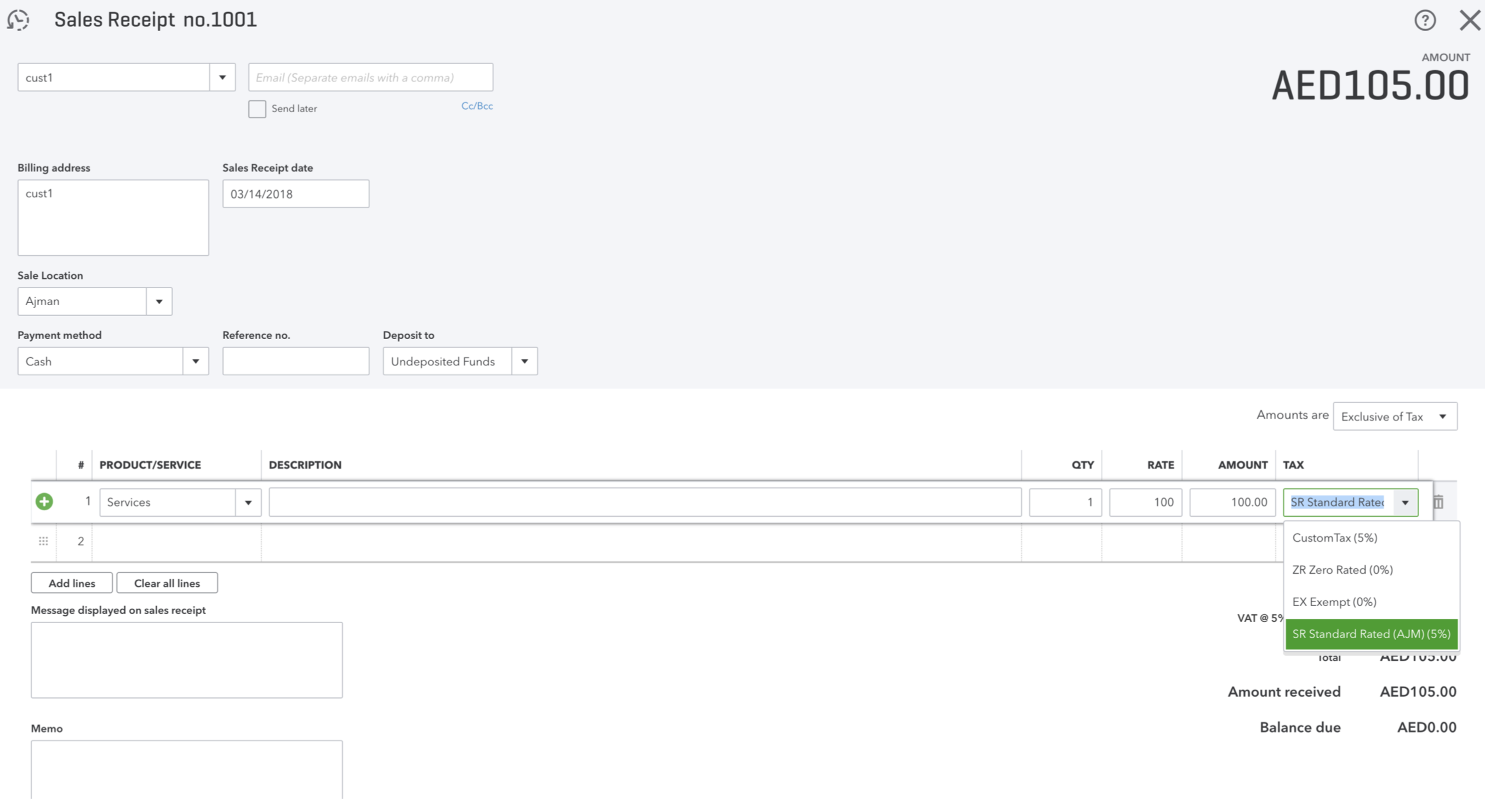

A: Once you login to QuickBooks Online, the new set of VAT codes and agency options will be automatically set up for you. This allows you to use these features for any of the new transactions moving forward. Please refer to the screenshots below

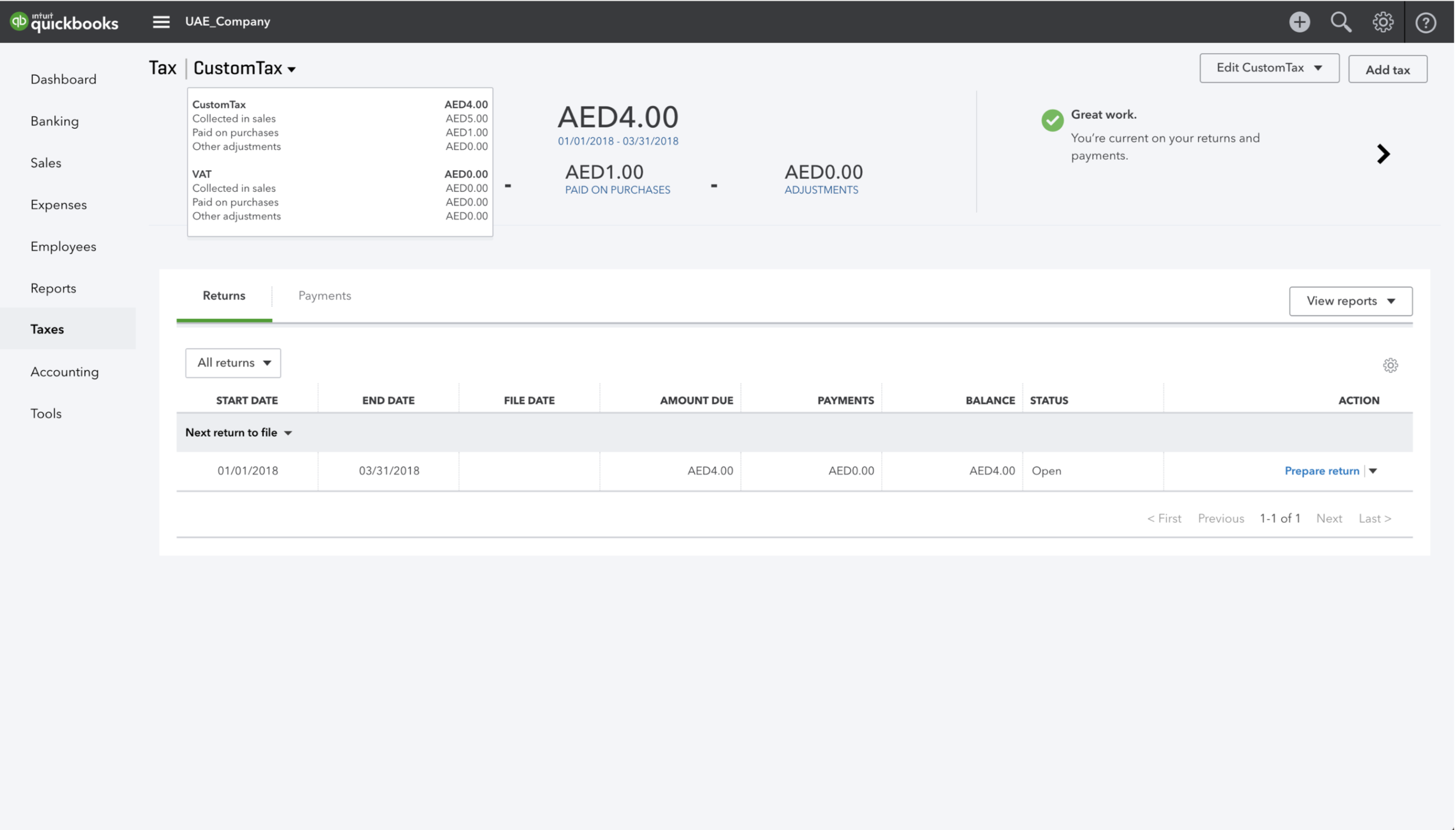

Q: How do I file my returns for my existing transactions?

A: You can file your returns using the custom tax agency that you have created. It is recommended to file the returns for existing transactions before recording new transactions using the new tax agency and codes. Your existing summary and filing reports will continue to work.

Q: Can I file my returns in new format with existing transactions.

A: Yes. The system allows you to choose the tax agency you would like to file the returns for. You can edit your current transactions to use new VAT codes and use system defined tax agency to file your returns which will generate the report in the new format. You are required however, to select a location for your transactions which is a new addition.

Q. How do I file my returns for new transactions?

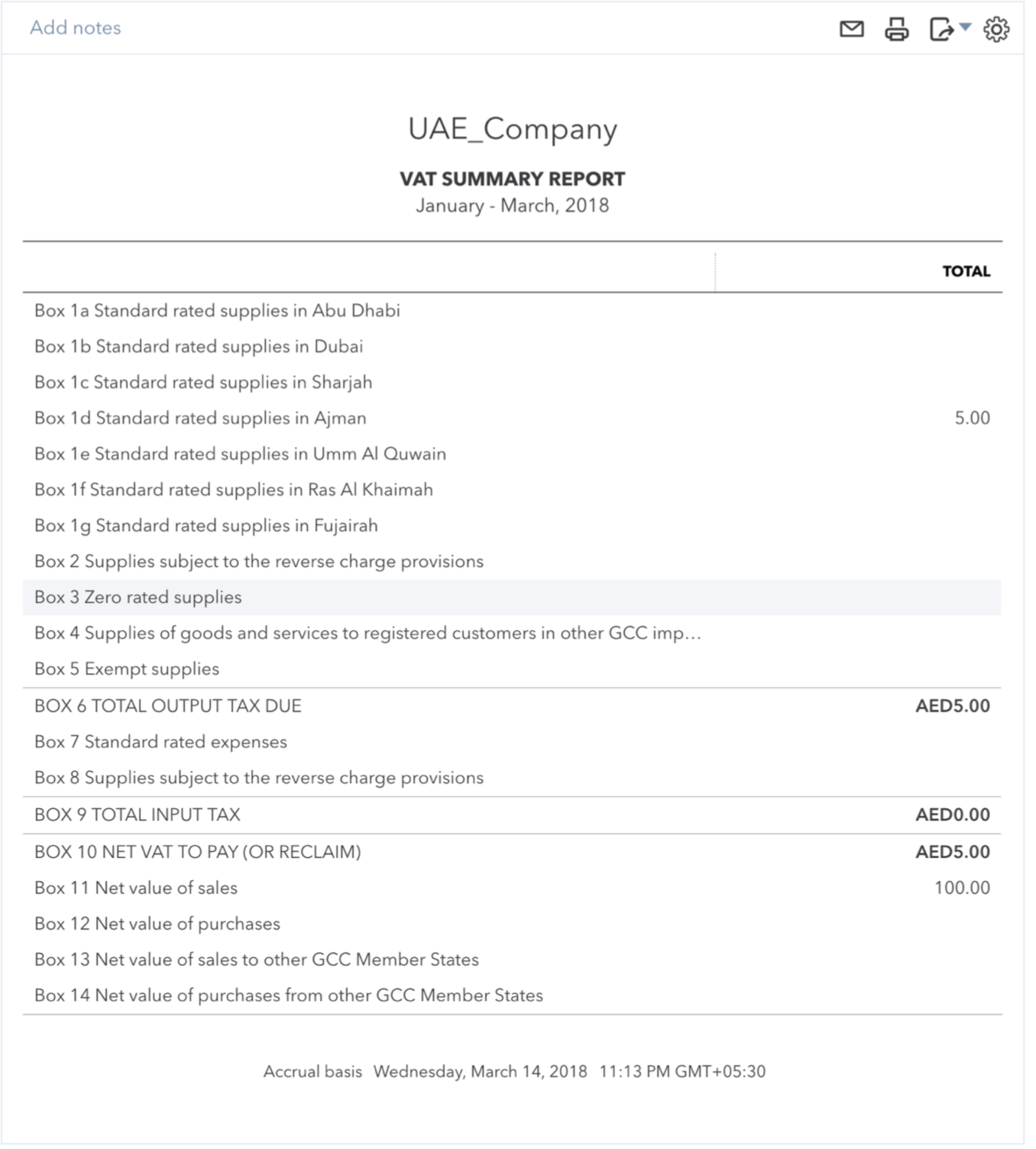

A: For all new transactions, use the new VAT codes and enter the location while creating the transactions. You should see a report like the one below with latest return form style.