Customize paychecks and pay stubs in QuickBooks Desktop Payroll

by Intuit•8• Updated 8 months ago

Learn how to make your paycheck and pay stub to look the way you want it to.

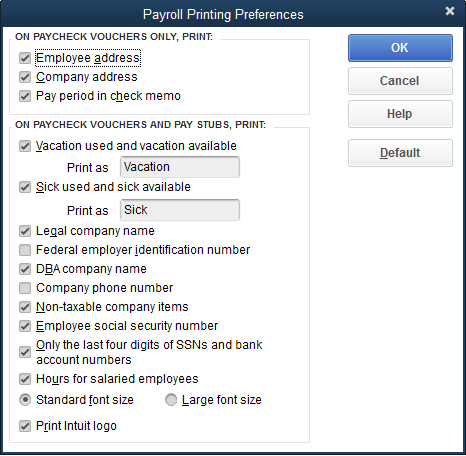

Want to customize your paychecks and pay stubs? QuickBooks Desktop lets you customize the info that displays and prints on a paycheck voucher or pay stub. You can also set up your preferred fonts for paychecks before you print them.

You must sign in to vote.

Sign in now for personalized help

See articles customized for your product and join our large community of QuickBooks users.

Find the right fit for your business

![[object Object]](https://digitalasset.intuit.com/content/dam/intuit/sbsegcs/en_us/quickbooks-online/images/SDR-qbo-rightrail.png)

Choose from plans and features to fit your business needs with QuickBooks Online.

More like this