Learn how to create a payroll summary report to see what you've paid out in your QuickBooks payroll.

If you want a quick view of your payroll totals, including employee taxes and contributions, you can run a Payroll Summary report for any date range, or group of employees in QuickBooks.

Create a payroll summary report

The payroll summary report gives you the total payroll wages, taxes, deductions, and contributions. Here's how to run a payroll summary report.

Note that the dates in this report are by paycheck dates only, not pay period dates.

QuickBooks Online Payroll

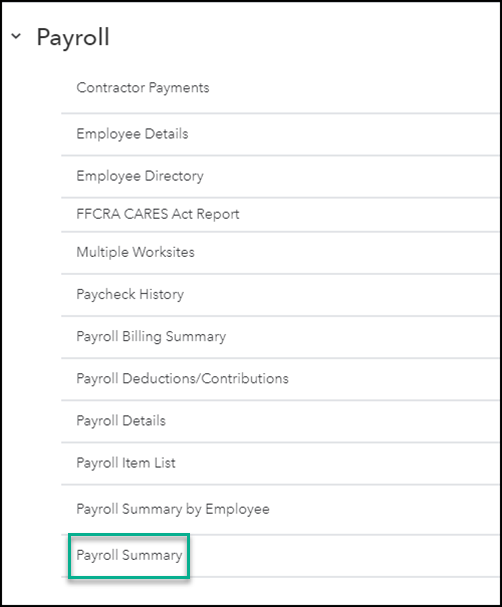

- Go to Reports and select Standard.

- Scroll down to the Payroll section, then select Payroll Summary. You can also enter the report name in the search field to find it.

- Set a date range, then select Apply.

- If you want to include or hide a specific detail in this report, select Customize then Run report.

QuickBooks Desktop

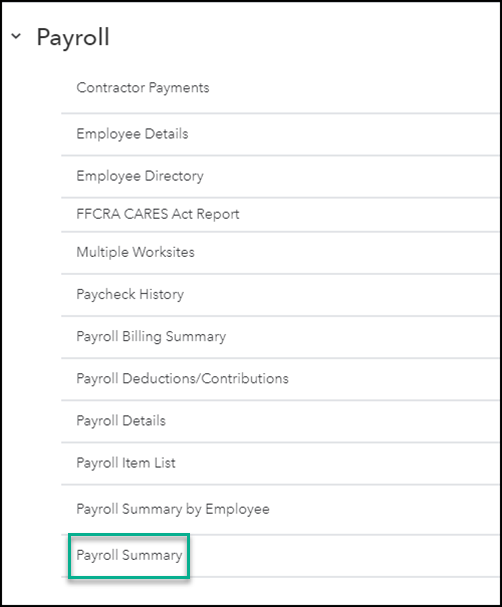

- Go to Reports and select Employees and Payroll.

- Select Payroll Summary.

- Adjust the date range appropriately.

- In the Show Columns dropdown, select Total only.

Create a payroll summary report by employee

Run a payroll summary by employee if you need to view the payroll wages, taxes, deductions, and contributions totaled by employees.

QuickBooks Online Payroll

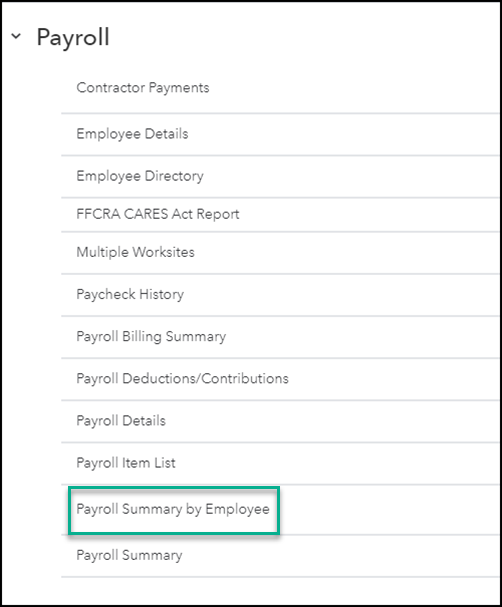

- Go to Reports.

- Scroll down to the Payroll section, then select Payroll Summary by Employee.

- Set a date range, then select Apply.

- If you want to include or hide a specific detail in this report, select Customize then Run report.

QuickBooks Desktop Payroll

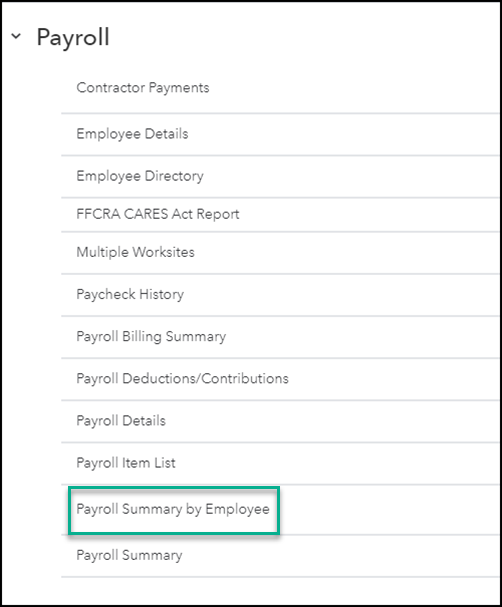

- Go to Reports and select Employees and Payroll.

- Select Payroll Summary.

- Adjust the date range appropriately.

- In the Show Columns dropdown, select Employee.

- Select Customize Report tab, then Filters tab.

- In the Choose Filter section, scroll down to select Name from the filter list.

- From the Name dropdown, select the employee.

- Select OK.