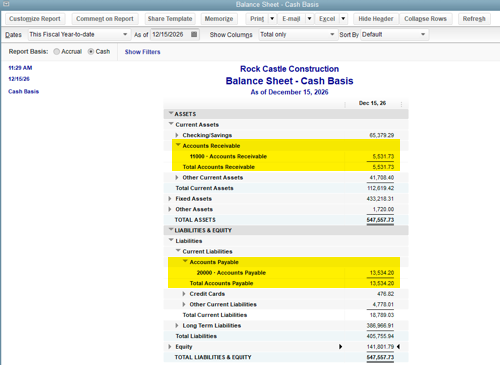

Learn how to resolve A/R and A/P balances on a cash basis balance sheet report in QuickBooks Desktop.

A balance sheet report in cash basis shouldn’t show A/R or A/P balances because these accounts track open (unpaid) invoices and unpaid bills. If they show up, here’s how to fix the issue.

Identify the root cause transactions

The following reports should help you find the root cause transactions:

Run an Open Invoices report

- Go to Reports, then select Customers & Receivables.

- Select Open Invoices.

- Select the Date ▼dropdown then select the correct date.

- Select Customize Report, then select Advanced.

- Select Report Date, select OK, then select OK again.

The payments that appear on the report (included in the CBBS) have been received but not applied to an invoice.

Run an Unpaid Bills report

- Go to Reports, then select Vendors & Payables.

- Select Unpaid Bills Detail.

- Select the Date ▼dropdown then select the correct date.

- Select Customize Report, then select Advanced.

- Select Report Date, select OK, then select OK again.

The bill payment checks that appear on the report (included in the CBBS) have been entered but not applied to a bill.

Run a Customer Transaction Detail report

- Go to Reports, then select Company & Financial.

- Select Balance Sheet Standard.

- Select Customize Report, then select Cash.

- Delete the From date, then select OK

- Double click the A/R amount to bring up the Transactions by Account report.

- Select Customize Report, delete the From date, then select Advanced.

- Select Report Date, then select OK

- Select Customer in the Total by ▼ dropdown.

- Select Filters.

- .Select Customer in the Total by ▼ dropdown.

- Select All accounts receivable in the Account ▼ dropdown.

- Select No under Include split detail.

- Select Paid Status in the FILTER▼dropdown, select Open, and then select OK.

Each nonzero customer subtotal affects the A/R balance.

Run a Vendor Transaction Detail report

- Go to Reports, then select Company & Financial.

- Select Balance Sheet Standard.

- Select Customize Report, then select Cash.

- Delete the From date then select OK.

- Double-click the A/P amount to bring up the Transactions by Account report.

- Select Customize Report, delete the From date, then select Advanced.

- Select Report Date, then select OK.

- Select Vendor in the Total by ▼ dropdown.

- Select Filters.

- Select Account in the FILTER ▼ dropdown.

- Select All accounts payable In the Account ▼ dropdown.

- Select No under Include split detail.

- Select Paid Status in the FILTER ▼ dropdown, select Open, and then select OK.

Each non-zero vendor subtotal affects the A/P balance.

Fix the root cause transaction

Important: Back up the QuickBooks company file before you proceed with these steps.

- Change your Sales Tax preference to Upon receipt of payment (Cash Basis).

- Link transactions in the Receive Payment window (A/R).

- Link transactions in the Pay Bills window (A/P).

- Be sure that your service, non-inventory part, and other charge items are linked to income and expense accounts:

- Go to Lists, then select Item List.

- Look for any balance sheet accounts (assets, liability, or equity) listed in the Account column.

- Make sure items with asset accounts are set up correctly. Some items like sales tax and retainers should have asset accounts.

- Temporarily delete the transactions you identify as problems.

- Memorize the open transactions and then delete them.

- Print your cash basis reports.

- Reenter the transactions from the memorized transactions list.

- Edit your journal entries.

- Separate the A/P and A/R of journal entries with several transactions involving balance sheet accounts, into separate JEs.

- Move the A/R to the first line (source) of the JE. JEs with an income or expense account will drop off the report. JEs with a balance sheet account will remain on the report.

Note: Every QuickBooks transaction has one source account and one or more target accounts.

Make changes to prevent future problems to your procedures

Note: Don't use Inventory items if you only have very few actual inventory items.

- Write off your inventory.

- Deactivate your inventory items.

- Re-create them as non-inventory parts.

- Use only cash transactions such as checks, sales receipts, and credit card charges.If you must use invoices and bills, make sure that none of the targets have balance sheet accounts.

- Track A/R and A/P in separate data files.

- Enter only cash transactions in the main (or cash) data file.

- Enter only accrual transactions into the secondary (or accrual) data file.

- Delete the open accrual transactions and reenter them as cash transactions when the cash has been paid out or paid in.