Learn how to track your inventory in QuickBooks Online Plus and Advanced.

QuickBooks Online has everything you need to manage your inventory. Track what's on hand, get alerts when it’s time to restock and see insights on what you buy and sell. You can also enter non-inventory products and services so you can quickly add them to your sales forms.

We’ll help you set it all up and get going.

Inventory features are available for QuickBooks Online Plus and Advanced. If you don’t have Plus or Advanced, upgrade your QuickBooks plan to start tracking your inventory.

To watch more how-to videos, visit our video section.

Step 1: Turn on inventory tracking

If you haven’t yet, turn on these settings so you can add your inventory.

- Go to Settings

and select Account and settings.

and select Account and settings. - Select the Sales tab.

- Select Edit ✎ in the Products and services section.

- Turn on Show Product/Service column on sales forms.

You can also turn on price rules if you want to set up flexible pricing for the things you sell. - Turn on both Track quantity and price/rate and Track inventory quantity on hand.

- Select Save and then Done.

Step 2: Add your inventory products

Now you can add your inventory items as well as other products and services you sell into QuickBooks. This lets you quickly add them as line items to your sales forms. The steps to add inventory, non-inventory, and service items are slightly different:

Add products you want to track as part of your inventory

Follow the steps to add inventory items. These are products you sell that let you set and track product quantities.

Add products and services you buy or sell, but don’t track as part of your inventory

QuickBooks won't track quantities for these items.

Step 3: Keep track of what sells

Once you set up all your inventory products, you track them when they sell. To track what you sell:

QuickBooks then decreases what’s on hand by the amount on the invoice or sales receipt.

Check what’s on hand and what’s on order as you work

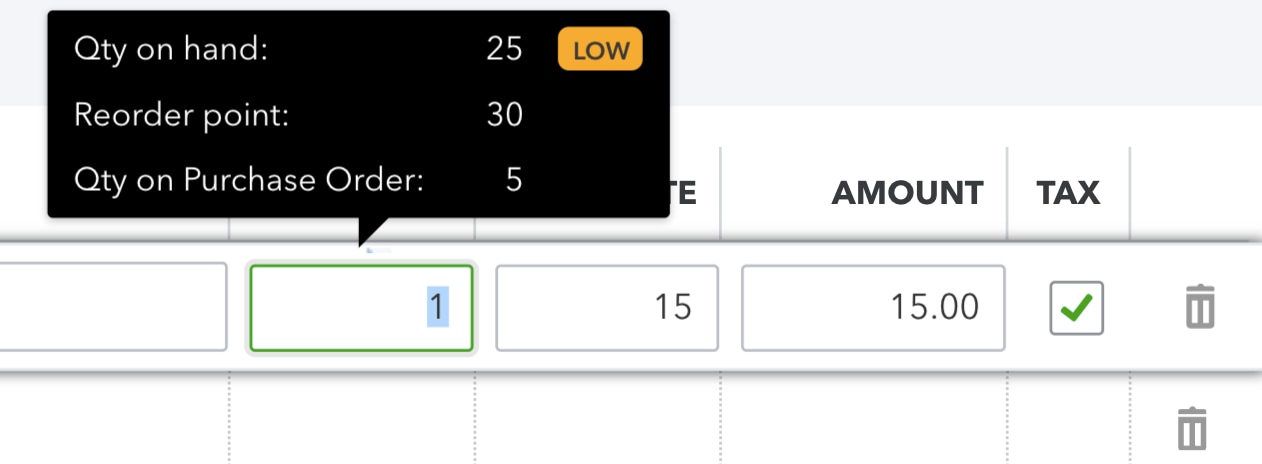

Check what’s on hand and what’s still on order as you work on an invoice, sales receipt, or another type of transaction. Just hover your pointer over the quantity you entered for an item to see more info.

If you set reorder points, QuickBooks will also let you know when something's running low. If you set a low stock alert, QuickBooks will also let you know when something's running low.

Step 4: Restock your inventory

QuickBooks tells you when it’s time to restock. You can order inventory right in QuickBooks. Then, track what you receive from vendors and what’s still on order. When you do, the quantity on hand automatically increases by the number of items you receive.

Learn how to reorder anything that’s running low or out of stock.

Step 5: Use reports to check the status of your inventory

Access reports to instantly see your best sellers, what’s on hand, cost of goods, and more.

Learn how to use reports to see inventory status and performance.